Donation Income Sources Explained: How Organizations Fund Their Impact

Donation Income Sources Explained: How Organizations Fund Their Impact

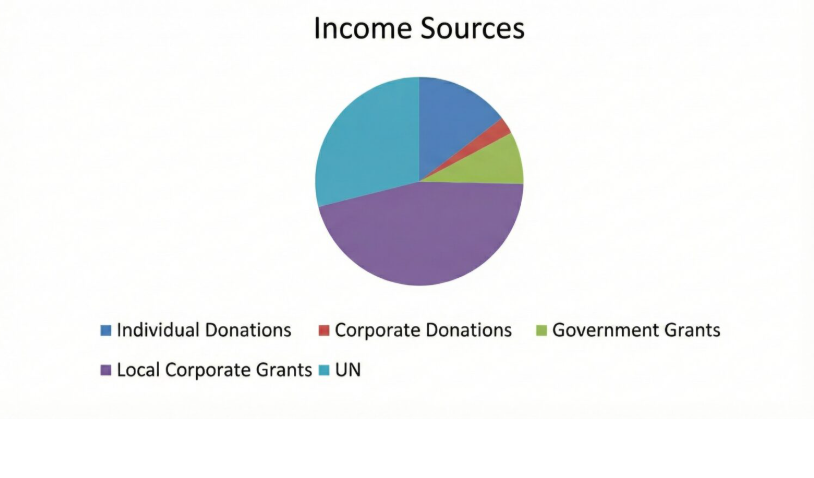

Income from donations is made up of several sources, avoiding too heavy an emphasis on any one of them. Such diversification adds financial resilience to the organization, thereby allowing programs to go on when any one funding source brings about changes.

Corporate-funding donations encompass local corporate grants, UN support, individual support, government grants, and corporate donations.

Local Corporate Grants: The Bigger Contributor

Local corporate grants occupy the bigger share of organizations’ income. This shows the strong support from local businessmen and corporate partners in the area of community development and social impact.

They speak of long-term partnerships founded on shared values, and indicate that local organizations are awake to the commercial benefits of backing certain initiatives that will yield measurable impacts in their communities.

UN Support: The Strongest Pillar of Funding

UN support stands as the next huge beacon for funding. This type of funding targets international development goals, humanitarian purposes, and sustainable objectives that favor and empower beneficiary-vulnerable groups.

Funding backstopped by the UN serves to legitimize-and to some point-sustain the financial support to the organization. Through the UN funding, such large programs, capacity-building aspects, and long-term projects that require sustainability for financing have been possible.

Individual Donations: Community-Driven Support

Individual donations account for quite a significant share of income and seriously affirm the credibility of the organization in the public domain and in the community. These public donations go far beyond testaments of faith and strong beliefs in the mission and impact of the organization.

Even the smallest of individual contributions, when aggregated, stand strong together to maintain operations, assist beneficiaries, and reach out.

Government Grants: The Structured Form of Institutional Support

Government grants constitute quite an important share of income. Generally such grants are awarded for specific programs, social initiatives, or developmental goals.

Government funding secures public accountability and compliance, and in so doing enhances the capacity of the organization to address public needs in a wide way.

Corporate Donations: The Smallest Share

Corporate donations reflect the smallest share of gross income. Smaller relative to funding from other hands, they nonetheless are very much valued in support of particular initiatives, events, or short-term programs.

As corporate involvement increases and awareness heightens, this window for corporate donations has the potential for great growth in the near future.

Why Donations Must Be Diversified

Having a donation system that is diversified reduces financial vulnerability and guarantees continuity. Multiple streams of funding instil in the organization;

Operational stability

Flexibility to receive fund alterations

Strengthen transparency and trust

Plan with confidence for long-term initiatives

There is sustainability in such balanced measures, a trademark of prudent financial planning.

Conclusion

From analysis of the data surrounding donation income, one gathers an idea of a well-balanced blend of funding sources where local corporate grants occupy the lead, UN support follows, and individual donations are seconded on with a backing of government grants and corporate donations. This diversity strengthens the organization with an ability to yield sustainable impact and accountability in a more sustainable manner.

Availability of sources for donation income that are balanced and transparent will earn the organization trust from donors and partners, thereby guaranteeing future success.